What’s the Buzz, Tell Me What’s Happening . . .

President Donald Trump’s tax overhaul, introduced in 2017 and extended on the Fourth of July, 2025, brought hefty cuts to government revenues. Yet no one benefited. Apparently.

The poor say they don’t; the rich do. The rich say they don’t; the poor do. To settle matters, the U.S. federal government lobbied heavily to concur — surprisingly — with the rich: Trump’s One Big Beautiful Bill was passed to benefit the poor to the utter neglect of the wealthy. What’s more, those self-sacrificing wealthy fought ferociously with our affluent elected officials — that is to say, on the same side — to make those cuts permanent in order to relieve the burden of the only portion of society they care about, those poor people.

We, the thankful middling poor, know OBBB decreases tax rates for most of us. We also know the first trick of mendacious policymakers is the vulnerable percentile. And, unbeknownst to those policymakers, we the masses caught on to the inconvertible fact some time ago that a single percentile has no absolute size, but increases or decreases in direct proportion to the amount to which it is applied. So if President Donald Trump’s claim is true, that the poor benefit immensely from their 2% or 3% tax cut, how much more do the millionaires and billionaires benefit from their 2.6% tax cut? Rather than address this conundrum, Trump and his allies insist the rich got gouged but good — for our sake.

The W&M Committee issued an info sheet listing how OBBB helped the American poor 12 ways — inspired, no doubt, by Wonder Bread’s memorable marketing campaign.

To ensure the poor believe they benefit, the U.S. House Committee on Ways & Means issued an authoritative statement in February even as the battle raged: “Extending the Trump tax cuts delivers the biggest relief to working-class Americans and small businesses in a generation. Full stop.” And continued anyway: “Working families making less than $30,000 saw the largest tax cut of any income group thanks to the 2017 Republican tax law.”1

To hammer that message into the brains of nervous low-income earners throughout the land Trump toyed with the idea of recasting OBBB as the “Working Families Tax Cut Act.” (Working Americans, in Trump’s regal mind, are the poor of America.) That move, he thought, would finally staunch the poor’s doubts. His noble impulse soon ebbed, leaving a population of poor continuing to insist OBBB didn’t benefit them.

In another attempt to broadcast the poor benefited, the W&M Committee issued an undated two-page info sheet listing how OBBB helped the American poor 12 ways — inspired, no doubt, by Wonder Bread’s memorable marketing campaign.2 3 Once again, the mercurial percentile was flourished to dazzling effect: “The lowest 10% of earners saw 50% higher wage growth than the highest 10%.” It sounds good, but works out like this:

Chuck earns $24,000 a year operating the copy machine in a community college printshop. With his recent 4.5% raise,4 he can now look forward to an extra $1,080, bringing his annual wages up to $25,080. Bob, a regional manager of a large bank, experienced 34% lower wage growth than Chuck, specifically, 3%. The resulting increase for Bob — who earns $300,000 a year — is $9,000. Theresa, a talented real estate agent in an affluent metropolitan area, pulls down $2 million per annum, minus commissions. Her 3% wage growth adds $60,000 to her yearly compensation, dwarfing Chuck’s 50% higher wage growth.

Ignoring the numbers for a moment, it is worthwhile to note that, while Bob and Theresa are certainly happy with their raises, they were living very comfortably before. Chuck, with his 50% higher wage growth, will continue to struggle. A 12-year-old waif, indentured to shuck clams for 25¢ a day, has little hope to experience frequent enough 50%-higher-wage-growth events to be able to buy some of those clams for herself before she starves. No taskmaster would be so generous. Wage growth is great if you’re earning a living wage to begin with.

And, if anyone noticed, the info sheet’s fancy statistic had nothing to do with OBBB.

OBBB owns no responsibility for wrecking our little mountain cabin; it was the bear OBBB let back in that did it.

The government and its allies have been at odds to explain another aspect of this very curious tax bill. Though forecast to occasion a $340 billion drop in annual revenue, OBBB’s wealthy proponents say nonsense, it does nothing of the sort. When pressed, they are happy to explain: OBBB doesn’t introduce any tax cuts. It merely extends the 2017 tax cuts set to expire in 2025. Any loss of revenue would be due to those 2017 measures, not OBBB. In other words, OBBB owns no responsibility for wrecking our little mountain cabin; it was the bear OBBB let back in that did it. It’s D.C. logic. We’re supposed to get used to it.

Nor, proponents maintain, will OBBB increase the federal debt.5 Inconvenient to be sure are the querulous malcontents at the Congressional Budget Office who insist that it is OBBB, which explicitly extends the 2017 cuts, that will cause havoc. Those CBO experts estimate OBBB’s impact to be an increase in the current record-high national debt of $38 trillion6 to nearly $52 trillion by 2035. While vehemently denying that hogwash, lawmakers voted to raise the country’s debt ceiling by $5 trillion anyway — which experts say won’t be enough.

Terribly coincidentally, after publishing all that scaremongering trash about exploding debt, the CBO stated on August 18 that it will not be issuing its regular midyear budget update and will issue its next 10-year budget and economic outlook in early 2026. CBO gave no reason for the unexpected adjustment in its schedule.

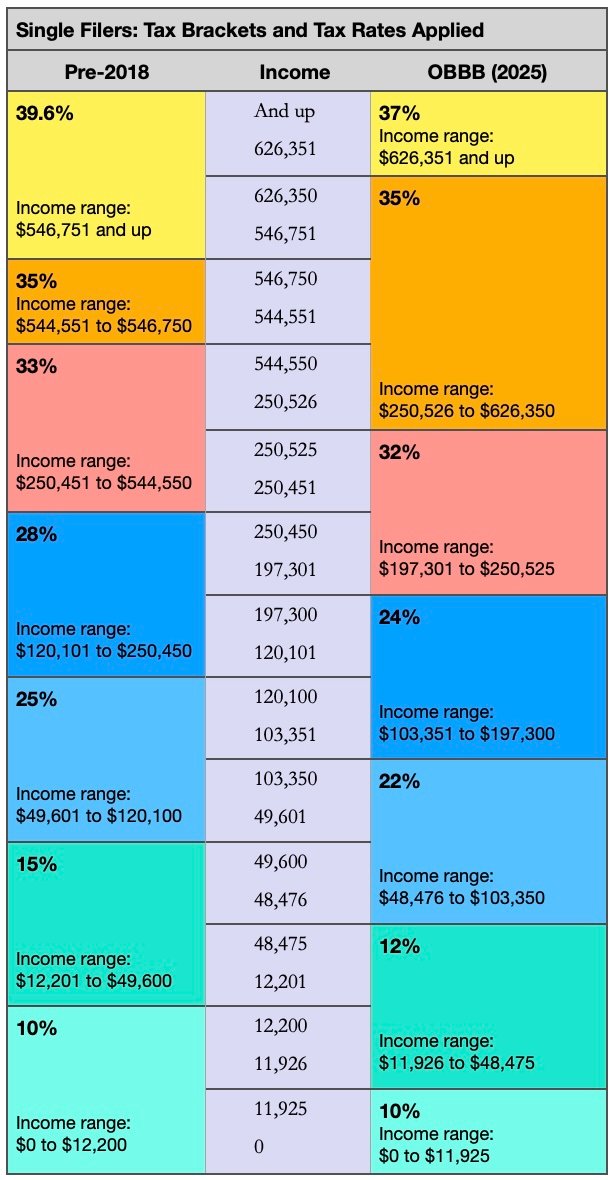

We heard little about the changes OBBB made to the tax brackets. A good thing. It would only have confused us.

While hearing OBBB was the best thing since the cotton gin for the poor and the best thing since indentured service for the rich, details about how those cuts effected so miraculous a transformation were scarce. We knew its huge tax cuts would benefit the poor or the rich or maybe nobody, but we heard little about the changes OBBB made to the tax brackets. A good thing. It would only have confused us.

Reagan’s Tax Reform Act of 1986 reduced the number of tax brackets from 15 to 4, something someone might say sounds like a significant simplification. OBBB does nothing so dramatic or helpful. It preserved the current seven-bracket structure but fussed with it. For example, it lowered the upper limit of the lowest pre-2018 tax bracket by $275 — from $12,200 down to $11,925. A cynic might argue the result of the bracket exercise was the point: total befuddlement. With those bracket adjustments, it is impossible to assess OBBB’s overall impact without diving deep into detail that no layperson or junior legislator has the patience to follow. Listed here are the tax brackets before and after the 2017/OBBB tax overhaul along with the tax rates applied to each. This is not meant to clarify, but to show how confusing the changes are.

After the wily percentile, the next best trick of slick policymakers is complicated language. Besides OBBB’s tax cuts, we heard rumors of deductions for tips, overtime, and interest on auto loans as well as whispers of more dubious items, like a 1% tax on remittances sent outside the U.S. and a phase-out of clean energy tax credits. Yet rumors they remained due to OBBB’S impenetrable language. When framing legislation designed to drain the blood of its citizens, policymakers are wise to keep the language complex. You don’t want your citizens understanding. In skimming the OBBB text on “Expanding access to care,” for example, you would be forgiven for not noticing that its amendment to Section 1915(c) of the Social Security Act does not expand, but restricts access to home healthcare.7

The bill’s overly complex language forces us to rely either on snappy info sheets that tell us OBBB is nothing but good or on other experts we hope are trustworthy and knowledgeable. It was an article from the Center for American Progress that provided the sobering explanation of how OBBB’s “Expanding access to care” makes it harder for states to fund home-based health services.7

One of OBBB’s juicy details, however, was not shared with us middling poor Americans, probably because it doesn’t concern us: Code Section 168(k) Bonus Depreciation revives 100% same-year write-offs for private business jets. With crafty consulting, the savings are very attractive indeed. As Outlier Jets informs on its Web site:

“One powerful strategy involves financing aircraft purchases while claiming full depreciation benefits. For example, financing 80% of a $10 million jet ($2 million down payment) while deducting the complete $10 million could generate over $3.5 million in first-year tax savings.”8

It is true that including this item in the Ways & Means Committee info sheet would have been of little interest to Chuck. Indeed, it is unfortunate that this resuscitated perk to ameliorate the plight of the gouged ultra-rich is projected to reduce IRS revenue by $363 billion over 10 years,9 but Trump is not worried. Rumor has it that he is thinking that just maybe he might suspend all budgetary reports until there are no poor people left.

- It went without saying that OBBB lifted the 2025 expiration date of that 2017 tax law. https://waysandmeans.house.gov/2025/02/25/correcting-the-record-trumps-tax-cuts-were-a-boon-for-the-working-class/ ↩︎

- The info sheet focused on 12 bullet points proving the poor in America were the luckiest poor on Earth thanks to Trump’s tax cuts. https://waysandmeans.house.gov/wp-content/uploads/2025/02/Correcting-the-Record-Trump-Tax-Cuts-Went-to-Wealthy.pdf ↩︎

- By 1930, Wonder Bread was one of the first sliced breads to be sold nationwide, owned at that time by Continental Baking Company. During the 40s, the company began injecting vitamins and minerals into it because manufactured white breads at the time were utterly deficient in nutrients. In the 50s, Howdy Doody and Buffalo Bob Smith told their audiences, “Wonder Bread helps build strong bodies 8 ways.” By the 60s, advertising proclaimed Wonder Bread “helps build strong bodies 12 ways.” And that’s how America grew strong and brave. ↩︎

- The Ways & Means info sheet states that in 2018 and 2019 wages increased 4.9%, highlighting it as the fastest 2-year growth in real wages in 20 years. ↩︎

- As of July 21, 2025, the Congressional Budget Office (CBO) “estimates that Public Law 119-21 will result in a net increase in the unified budget deficit totaling $3.4 trillion over the 2025-2034 period, relative to CBO’s January 2025 baseline updated to reflect enacted legislation. That increase in the deficit is estimated to result from a decrease in direct spending of $1.1 trillion and a decrease in revenues of $4.5 trillion.” A $3.4 trillion unified budget deficit over 10 years translates into roughly $340 billion a year. https://www.cbo.gov/publication/61570 ↩︎

- Since August, the government added a trillion dollars to the national debt, the fastest accumulation of $1 trillion to national debt outside of the COVID-19 pandemic. In August, the U.S. national debt was “only” $37 trillion. A useful overview of the progress the U.S. national debt has made this century:

2000: $5.67 trillion

2010: $13.56 trillion

2020: $26.94 trillion

2024: $35.46 trillion

August 2025: $37 trillion

October 2025: $38 trillion

Projection for the end of fiscal 2035: over $52 trillion.

https://www.reuters.com/business/us-budget-deficit-forecast-1-trillion-higher-over-next-decade-watchdog-says-2025-08-20/ ↩︎ - https://www.govinfo.gov/content/pkg/PLAW-119publ21/pdf/PLAW-119publ21.pdf ↩︎

- Why OBBB will make it harder for states to fund home- and community-based services:

“The OBBBA creates a new category in 1915(c) HCBS waivers that will cover people who do not meet the existing requirement of needing an institutional level of care to receive HCBS. States would be allowed to apply to access this funding as long as their proposed program does not increase the average HCBS wait times for people who meet the need for institutional care.” However, reduced federal funds means allocation for HCBS will cover about 27 people per state. “Moreover, states will be contending with massive federal funding losses due to the bill’s Medicaid cuts, which will likely lengthen wait times for HCBS, making them ineligible to establish the new category at all.” [emphasis added] https://www.americanprogress.org/article/the-truth-about-the-one-big-beautiful-bill-acts-cuts-to-medicaid-and-medicare/ ↩︎ - https://www.outlierjets.com/newsroom/2025-aircraft-bonus-depreciation-100-tax-write-off-guide ↩︎

- https://taxpolicycenter.org/sites/default/files/2025-08/A-Review-and-Assessment-of-the-Main-Business-Tax-Provisions-of-the-2025-Reconciliation-Act.pdf ↩︎

Now I’m confused, but thanks anyway!